Low demand leads to Unifi losses

Number one destination for spinning, weaving and knitting machinery by a large margin.

15th July 2024

Innovation in Textiles

|

Zurich, Switzerland

Shipments of new textile machinery increased in many segments in 2023, according to the 46th International Textile Machinery Shipment Statistics (ITMSS) compiled by the Zurich-headquartered International Textile Manufacturers Association (ITMF).

The 2023 survey has been compiled in cooperation with more than 200 textile machinery manufacturers to provide a comprehensive overview of world production and more than anything, underlines the continued dominance of China in making new investments.

Spinning equipment

In the spinning sector, global shipments of new short and long-staple spindles climbed by 2% and 5%, respectively, although there was a 17% fall in orders for open-end rotors compared to 2022. Deliveries of draw-texturing spindles meanwhile fell by 28%

The total number of shipped short-staple spindles increased by 155,000 units in 2023 to a level of 9.78 million. Most of the new shipments went to Asia (85%) where deliveries have been stable compared to 2022.

Shipments to Europe (including Turkey) and North and Central America decreased by 13% and 27%, respectively, and increased in Africa, primarily Egypt (+120% to 475,000) and South America (+140% to 81,000). The six largest investors in the short-staple segment were China, India, Turkey, Bangladesh, Uzbekistan and Egypt.

One million open-end rotors were shipped worldwide in 2023, 200,000 less than in 2022, with 85% of them, or 860,000, going to Asia. China, India and Turkey were the world’s three largest investors in rotors.

Global shipments of long-staple wool spindles increased to 98,000 units in 2023, up 5%, driven by a rise in deliveries to Europe and South America.

Texturing Machinery

Global shipments of single heater draw-texturing spindles mainly for polyamide filaments fell by 33% to 43,000 positions in 2023. With a share of 97%, Asia remained by far the strongest destination for single heater draw-texturing spindles, primarily China.

In the category of double heater draw-texturing spindles mainly used for polyester filaments, global shipments fell by 27% to 550,000 spindles. China continued to be the world’s largest investor, accounting for 91% of global shipments.

Weaving and knitting machines

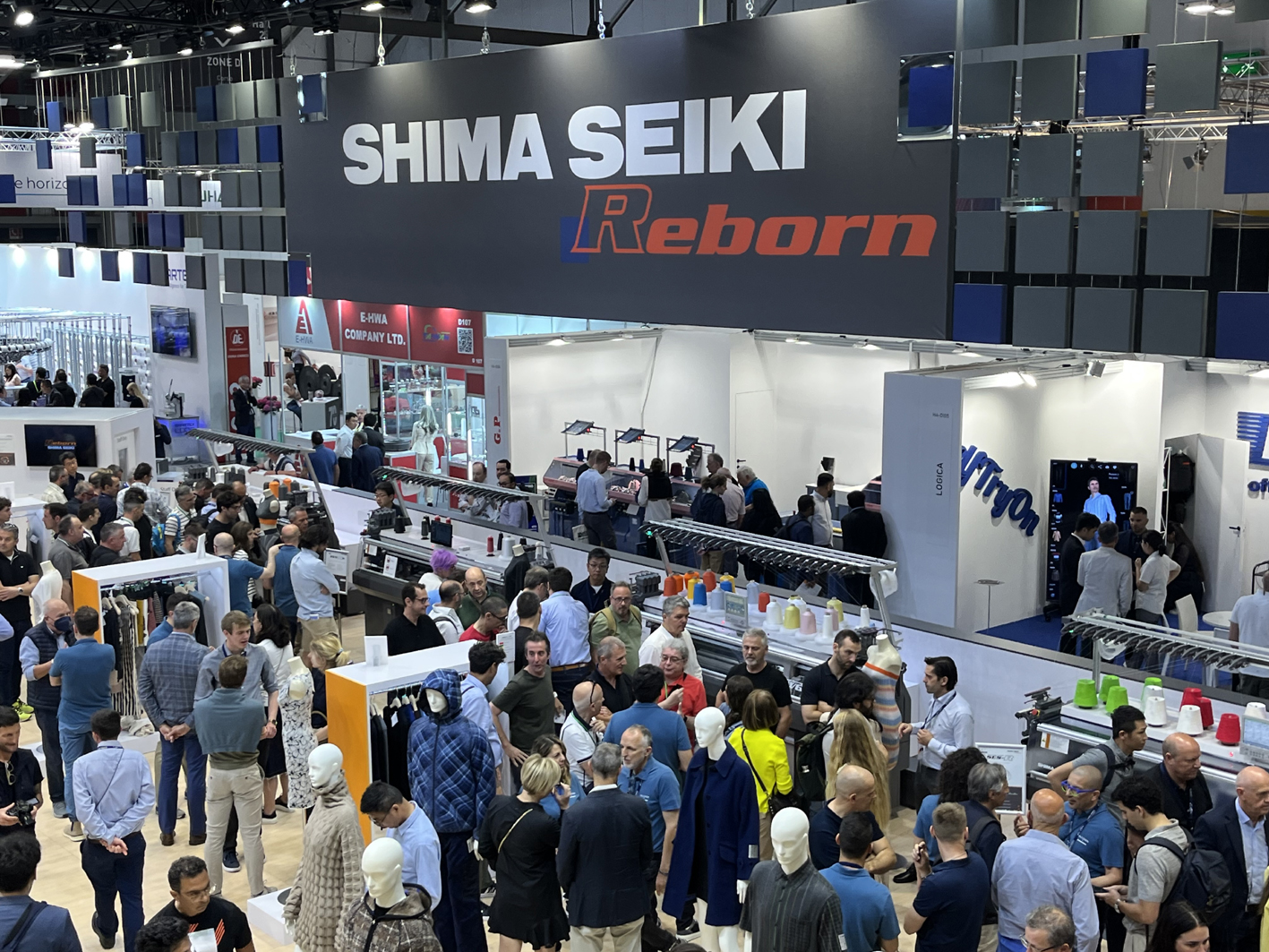

The number of shipped shuttle-less looms sold in 2023 climbed by 52%, shipments of large circular knitting machines were up by 17% and flat knitting machines by 60%.

In 2023, global shipments of shuttle-less looms increased by 52% to 171,000. Deliveries of air-jets grew by 34% to 53,000 and water-jets grew 96% to 92,000 looms. The number of rapier and projectile looms was flat compared to 2022 at around 27,000 units.

Unsurprisingly, Asia was the main destination for weaving machines, accounting for 96% of worldwide deliveries. The main investor in air-jet and water-jet looms was China while India led in rapiers and projectiles, ordering around 10,000 machines, down 8% on 2022.

Global shipments of large circular knitting machines increased by 17% to 33,000 units in 2023 with 86% destined for Asia and 63% for China – 18,476 units.

The number of shipped electronic flat knitting machines meanwhile increased by 61% to 177,000 machines in 2023, 92% going to Asia. China remained the world’s largest investor with an 82% share of total shipments.

ITMF’s data on the finishing segment is still being compiled and will be published in due course.

Business intelligence for the fibre, textiles and apparel industries: technologies, innovations, markets, investments, trade policy, sourcing, strategy...

Find out more