Major growth for patches in healthcare

Pressure during the Covid-19 pandemic a catalyst for rapid adoption.

28th November 2022

Innovation in Textiles

|

Boston, MA, USA

The stress test of the pandemic, a growing global population and increasing chronic disease prevalence is pushing healthcare to be more efficient and robust.

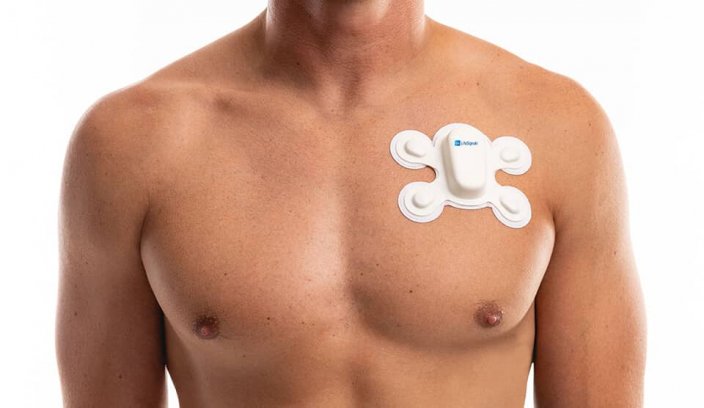

Technology is enabling this transformation and one significant form of wearable technology increasingly being adopted by healthcare systems is the electronic skin patch that can monitor physiology wirelessly and continuously.

In its recent report Electronic Skin Patches 2023-2033, market intelligence firm IDTechEx explores where these emerging devices can add value in different aspects of healthcare.

ECGs

Atrial fibrillation (AF), the most common type of heart rhythm disorder, greatly increases a patient’s risk of a stroke and due to its intermittent nature, is a very challenging disease to diagnose. To detect it, doctors monitor the patient’s heart rhythm with electrocardiograms (ECGs), firstly with a 12-lead ECG in the clinician’s office, and if more data is needed over a longer period, with a Holter monitor for a 24-hour period.

These incumbent monitors are bulky, wired, and uncomfortable for patients, who consequently often pull off the wires and disturb readings. Patient comfort and adherence to monitoring has been the biggest problem clinicians have faced and the key value skin patches provide.

Adherence to an ECG monitoring programme is significantly improved with skin patches compared to conventional machines, and patients are able and more willing to wear them for 48 hours or longer. This has enabled a rapid rise in longer-wearing monitors – extended-wear Holters and mobile cardiac telemetry devices – throughout the 2010s. The success of ECG electronic skin patches has not gone unnoticed, and the 2020s have seen a consolidation in this space, including the acquisitions by Philips of Biotelemetry, Boston Scientific of Preventice Solutions and Baxter of Bardy Dx.

Pandemic staff shortages

Pressure during the Covid-19 pandemic has been a catalyst for the rapid adoption of electronic skin patches as part of a greater trend towards remote patient monitoring.

The pandemic stretched hospital systems and created staffing shortages and patches were well-suited to relieving some of the pressure.

With wireless communication, automated and continuous monitoring and battery-outlasting quarantine periods, these devices allowed caregivers to monitor several patients in parallel via virtual wards.

Several players with remote vital signs monitoring skin patch platforms, including Lifesignals, Vivalink and Vitalconnect, saw increased interest in fever monitoring applications and going forward, remote fever monitoring will add a lot of value for spotting infections early in vulnerable patients.

A key example is with patients with neutropenia (a reduced white blood cell count) after discharge from chemotherapy, where earlier fever detection via an electronic skin patch worn at home can go a long way to reducing risks and treatment intensity.

Decentralised clinical trials

Not only did the pandemic change the healthcare status quo, but it also profoundly affected the pharmaceutical and biotechnology industry. The periods of lockdowns around the world significantly impacted the running of clinical trials, and this triggered companies to adopt a model of decentralised clinical trials – a new market opportunity for electronic skin patches.

The rise in such trials will continue to grow, providing two key benefits. Firstly, they can reduce the drop-out rate of trials, often a major cause of failed trials by removing the challenge of travelling to sites. Secondly, removing the burden of routine meetings can increase the ability of a clinical trial to reach deprived populations and increase the diversity of the study. The use of electronic skin patches in decentralised clinical trials is still new and their overall value is yet to be clearly demonstrated, but more partnerships between pharmaceutical companies and skin patch players are expected in the coming years.

The IDTechEx report estimates that the electronic skin patch market will grow to a value of over $27 billion by 2033.

Business intelligence for the fibre, textiles and apparel industries: technologies, innovations, markets, investments, trade policy, sourcing, strategy...

Find out more